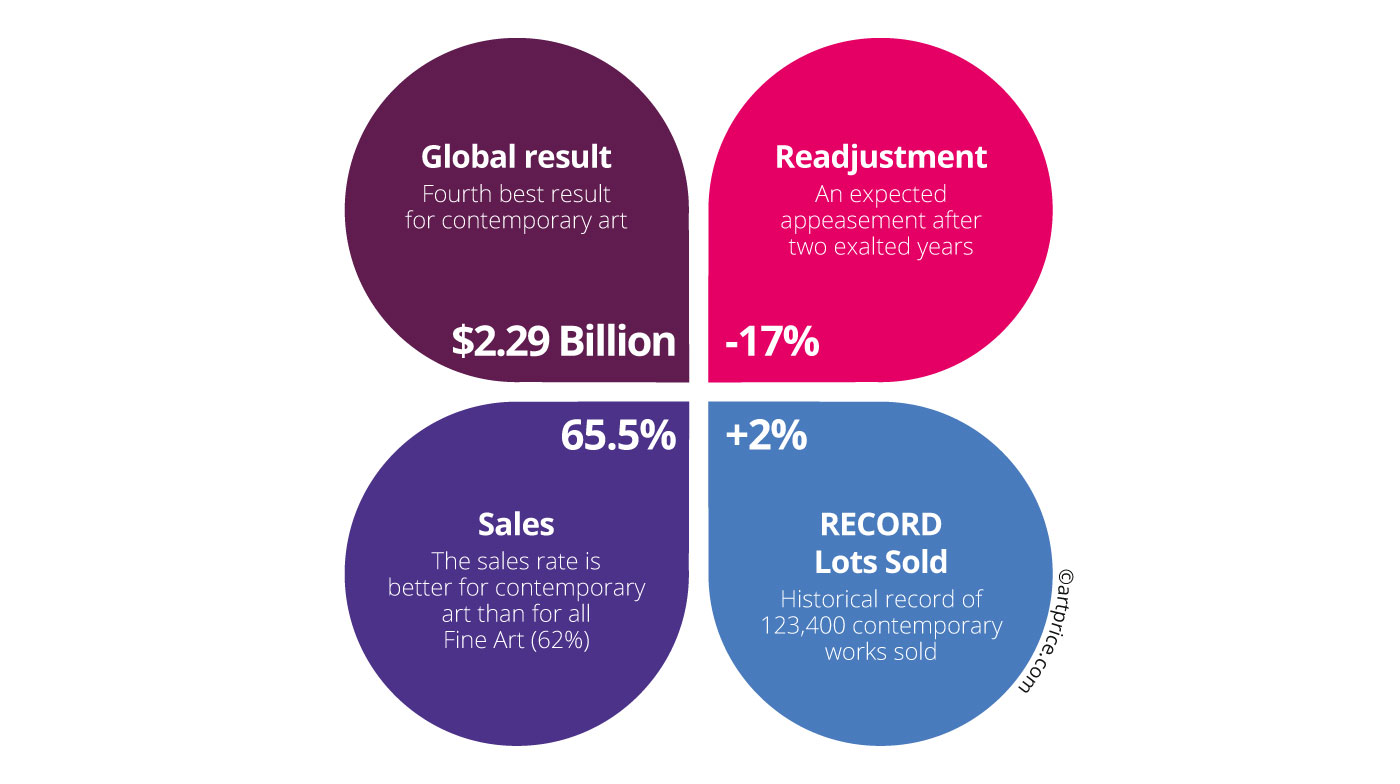

Key figures

The Contemporary art market is undergoing a controlled correction while continuing to attract new buyers.

After two years of phenomenal growth and a historic increase in auction turnover following the Covid crisis, the Contemporary art market appears to have followed the general trend observed on the art market as a whole: an anticipated de-escalation in the high-end segments. The post-pandemic frenzy being clearly a cyclical movement, global turnover was bound to return to a more moderate and sober growth path.

In 2020, the health crisis generated unprecedented constraints leading to a near paralysis (postponements and cancellations) of auction sales during the first half of the year and to the temporary unavailability of masterpieces that usually drive the market.

Following this period of forced inactivity, the sales companies quickly bounced back: Sotheby’s, Christie’s and Phillips all took on prestigious consignments at the start of summer of 2020 and collectors were clearly eager to get back into the market. In 2021 and 2022, museum-quality pieces from prestigious collections fueled a series of exceptional auction sales in the Modern Art and Post-War segments… and the Contemporary Art segment reached a new 12-month record at $2.7 billion!

Following this extremely opulent 2021/2022 period, the results from the Contemporary art segment look substantially more modest, although the overall turnover figure is a perfectly respectable $2.29 billion and 2022/2023 turned out to be the fourth best performance in history. In fact, that total is twice the one generated during the health crisis, and 25 times higher than that counted 20 years ago (only $90 million in 2002/2003).

In short, the general contraction observed this past year reflects, above all, an unfavorable comparison effect (since last year was exceptionally good). Indeed, considering the multiple tensions experienced since the start of the war in Ukraine, it seems more pertinent to highlight the exceptional resilience of the global art market.

Evolution of annual Contemporary art auction turnover

The Contemporary art auction market adjusted following the post-Covid boom and posted the fourth best-ever performance in its history.

Over the past year, the global context has been particularly disruptive. Geopolitical and economic tensions, war, recession and inflation are all – à priori – unfavorable factors for the public sale of major artworks. Although we have still seen one or two examples of passionate buying of the most beautiful works at exceptional prices, a lot of collectors have demonstrated an understandable reserve, sometimes choosing to postpone their decision to sell, or even going through other channels to part with their works by ‘blue chip’ artists (the most recognized and expensive artists on the market). In a less euphoric climate than that of the impressive market recovery after the health crisis, the current caution is in fact a virtue and the nevertheless convincing results of 22/23 have revealed with greater clarity how the dynamic of art collection is still very much alive.

Fine art auction stats for the year 2022/2023

The pace of transactions reaches an all-time high

The incredible vitality of the Contemporary Art Market is clearly visible in the record volume of transactions, even higher than in the post-Covid rebound a year earlier. In 22/23, the global Contemporary art market exchanged an absolute record number of artworks: more than 123,000. This is an exceptional volume, twice that observed ten years ago, and 100 times that observed at the beginning of the 2000s.

The global Contemporary art market recorded an absolute record volume of transactions in 22/23: more than 123,000, a density 100 times greater than that recorded at the beginning of the millennium.

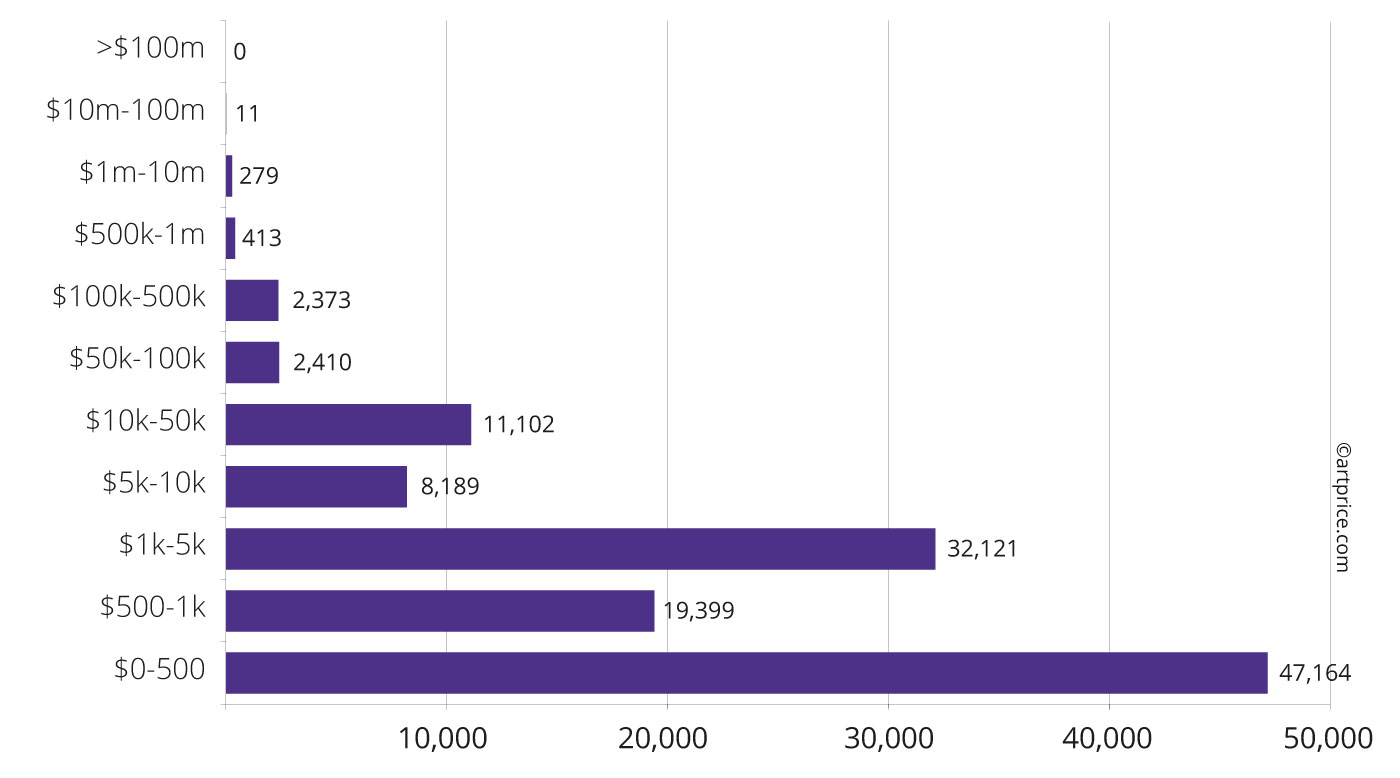

Exchanges accelerated considerably on artworks offered for less than $5,000. In fact, this price segment is the most buoyant on the market, with nearly 99,000 Contemporary artworks exchanged, i.e. three times higher than a decade ago and, above all, a new peak for the auction market! This historic record for contemporary artworks sold for under $5,000 is the best indicator of the constant expansion of the art market.

Compared with the circulation of tens of thousands of ‘affordable’ artworks, the million-dollar transactions on works by ‘blue chip’ artists is essentially a micro-market. After the Covid crisis, 7-digit auction results reached a historic high of 372 lots in 2021/2022. This year, the rhythm is less frenetic but nevertheless buoyant with 290 Contemporary artworks fetching prices above the million-dollar threshold, including 11 lots above the 10 million threshold. Naturally, variations in the volume and prices of ultra high-end art sales involving rare works chased by a small number of buyers have a substantial impact (several tens or even several hundreds of millions of dollars) on global auction turnover figures from one year to the next. But they do not really represent the art market as a whole.

Breakdown of Contemporary art auction results per price range

0

0